Scenario Planning Tools

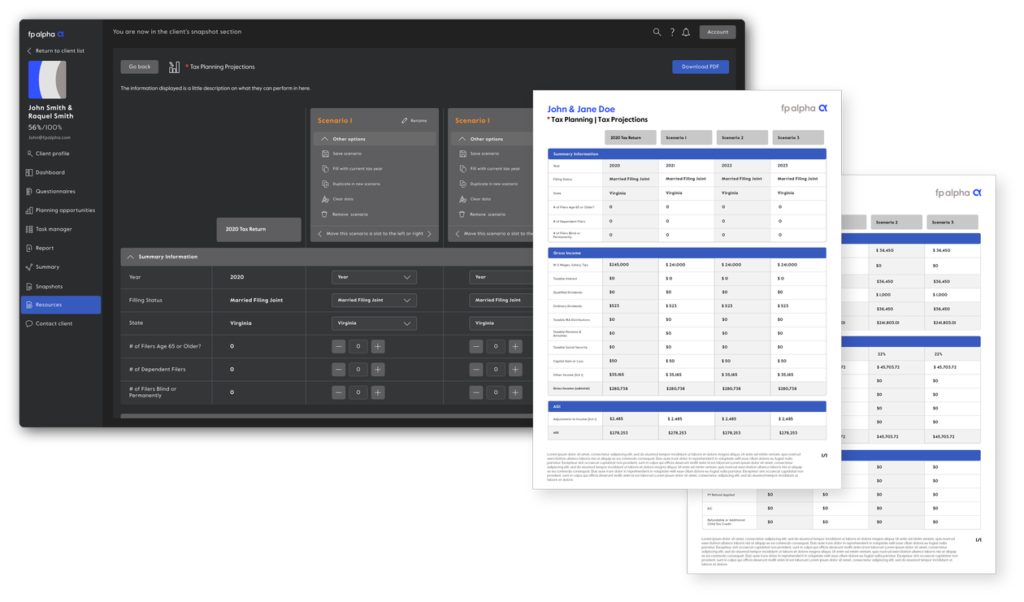

The Tax Projector Tool

- Provides advisors the ability to project and compare various tax scenarios and strategies for their clients, simply by uploading their tax documents.

- Projects and compares various federal and state tax scenarios including the ability to project client income taxes out multiple years and compare dozens of different scenarios such as a change in client filing status or income levels.

- Allows advisors to compare multiple tax planning strategies at the same time such as Roth conversions, charitable giving, and other income related planning techniques, enabling advisors to reduce clients’ tax bills and get credit for their work.

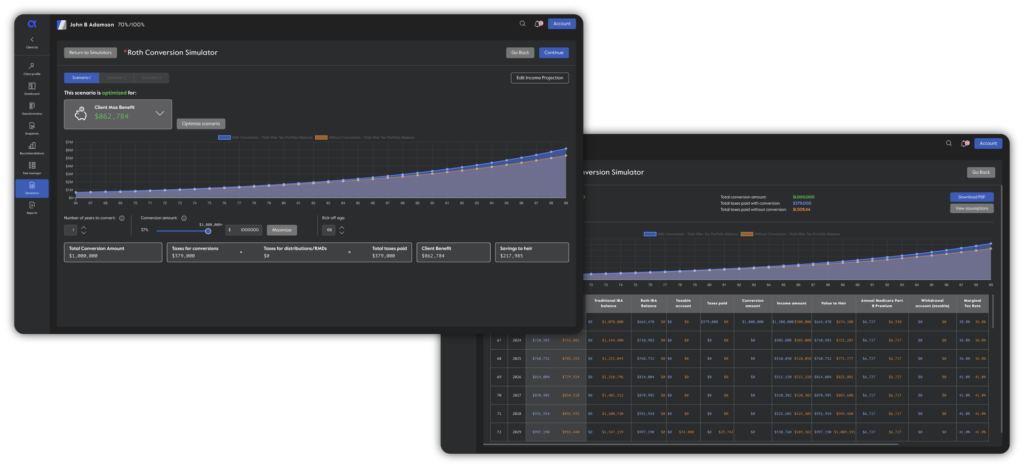

The Roth Conversion Simulator

- Enables advisors to identify how much to convert, when to convert, and what it’s worth, simply by clicking a button.

- Allows advisors to customize inputs such as conversion amounts, years to convert, and kick-off age and the tool shows the effects of this conversion on the Roth account and Traditional IRA account as well as total taxes paid over the client’s lifetime.

- If an advisor is unsure of how much to convert or when, they can use the tool’s optimize function which will tell them exactly how much to convert, for how many years and at which age to start converting.

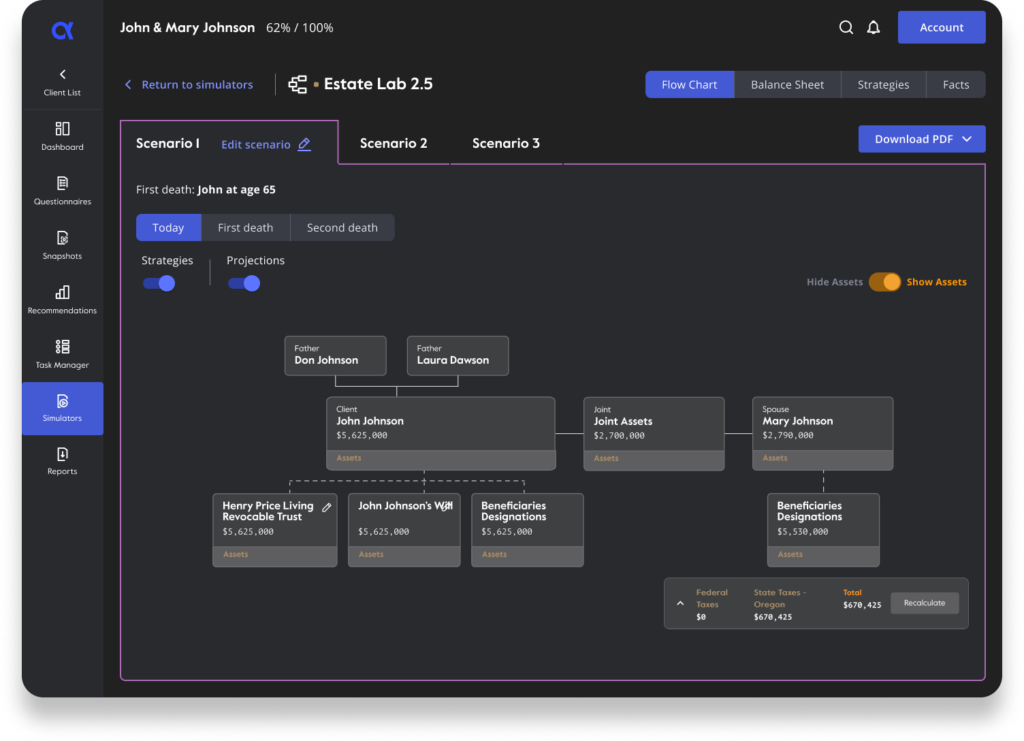

Estate Planning Lab

Model alternative estate scenarios, incorporating various vehicles, quantifying the value of state and federal estate tax reduction strategies.

Personalized Client Recommendation Report

A white-labeled and customized, actionable service plan for advisors to engage clients and provide impactful plan updates.

People are talking about us!

I wanted to work with FP Alpha because, as a fiduciary fee-only planner, I always wanted to be providing the best recommendations possible. Having FP Alpha gives me the ability to utilize world-class experts in different areas of planning such as quality assurance, making sure the recommendations I am making are accurate and allowing me to include other recommendations from the experts I may have missed. It’s like having a team of professionals working on every financial plan with me. Huge benefit to the client and just as big for a small firm such as mine.

Andrew J. Silver

Founder and CEO • Concordia Wealth Planning, LLC

FP Alpha exists to support advisors in providing clients with top-notch holistic advice, leveraging the advisor’s knowledge and time to provide clients with the best possible service. The speed at which the FP Alpha team has responded to our questions has been excellent. The system and tools are easy to use, and FP Alpha is constantly working to improve the software and roll out new and useful functions.

Stephen Fletcher

Senior Wealth Advisor • BlueSky Wealth Advisors, LLC

FP Alpha gives advisors with a security blanket to ensure we are doing everything in our power to provide our clients with the best advice possible for their unique situation.

Nathan Parkins

Wealth Advisor • MoLei Financial

FP Alpha has helped me to more quickly organize and identify financial planning opportunities in my practice.

Matt Smith

Founder and CEO • Concert Financial Planning

FP Alpha is one of the most exciting fintech firms. I'm thoroughly impressed!

Jason Pereira

Partner, Senior Financial Planner & Portoflio Manager, Creator & Host • Woodgate Financial, The Fintech Impact Podcast

FP Alpha’s revolutionary platform empowers advisors to play an integral part in the overall estate planning process. With The Estate Planning Lab, the advisor can identify and raise critical planning points, creating the opportunity to liaise between the client and the attorney, facilitating a more efficient review. By providing this additional service to your client, advisors can clearly demonstrate their value and justify their fee.

Marty Shenkman

Founder, Estate Planning Attorney • Shenkman Law

FP Alpha provides advisors with a competitive advantage as fee-compression continues to affect the advisory space. The technology provides impactful recommendations with limited insight into a prospect’s financial and personal circumstances—jump-starting relationships and allowing planning to be a living, breathing experience for all parties. I believe this technology is essential to the evolution of the industry as we enter into a new generation of wealth.

Joel Bruckenstein

Founder and CEO • Technology Tools for Today

FP Alpha starts its analytical work and recommendations where the typical planning process stops. FP Alpha will read wills, declaration pages, tax forms and other documents, and then deliver the expert advice of 40 specialized professionals.

Bob Veres

Founder • Inside Information

Scale Your Planning Today.

Schedule a demo to see FP Alpha in action.