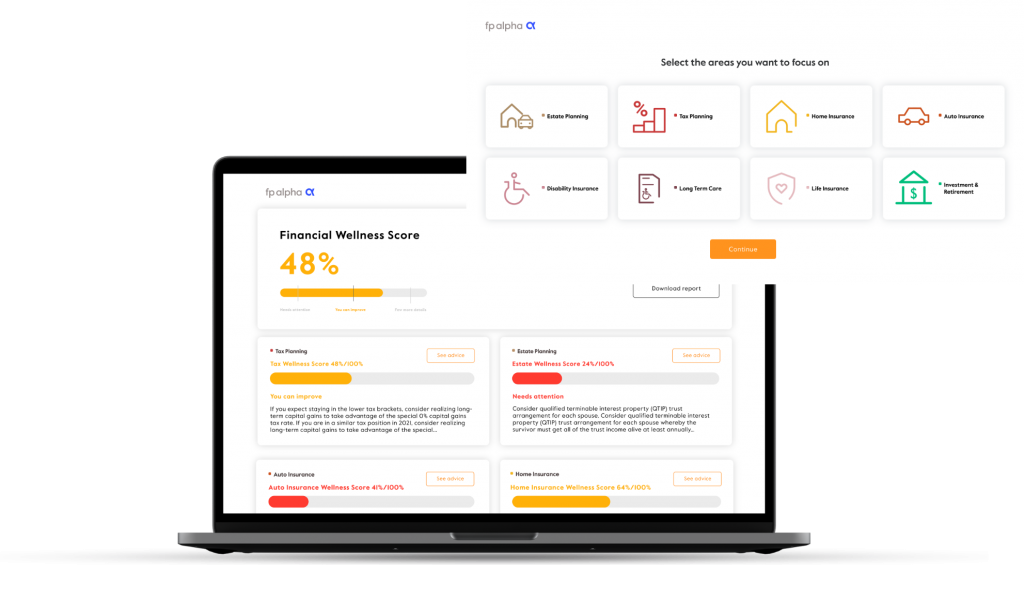

How FP Alpha Works

FP Alpha’s first-of-its-kind software makes it easy as 1-2-3 to offer holistic financial advice that scales for every client your firm serves.

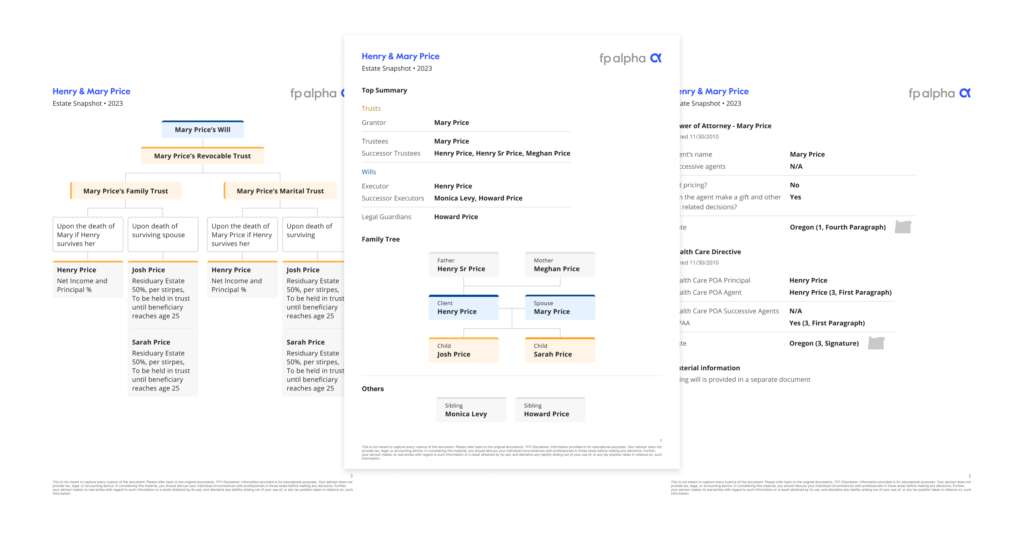

Upload Client Financial Documents

Get back hours spent reading tax returns, estate plans, and insurance policies.

Upload a document from your client straight into FP Alpha.

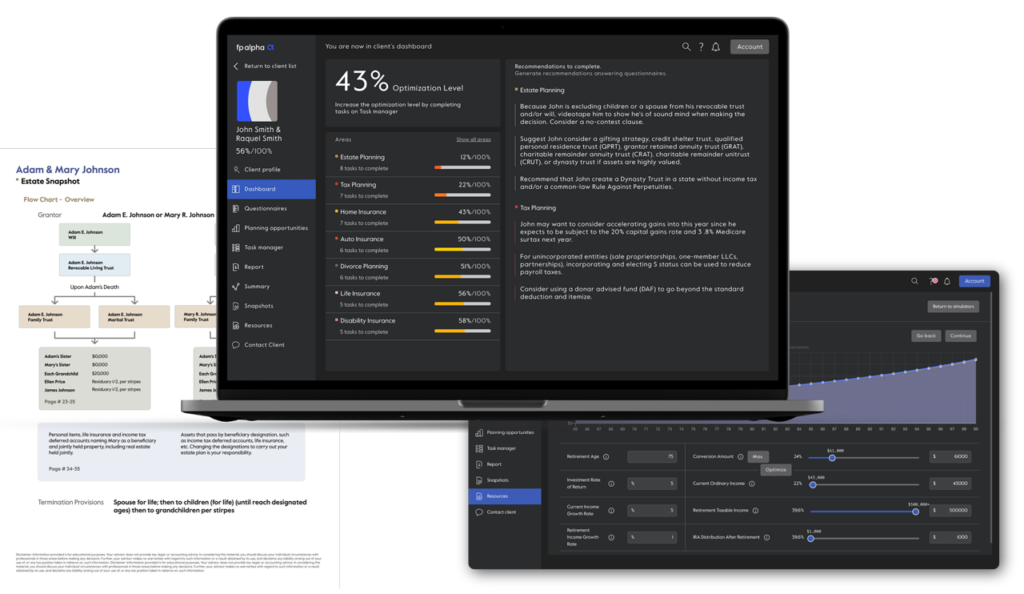

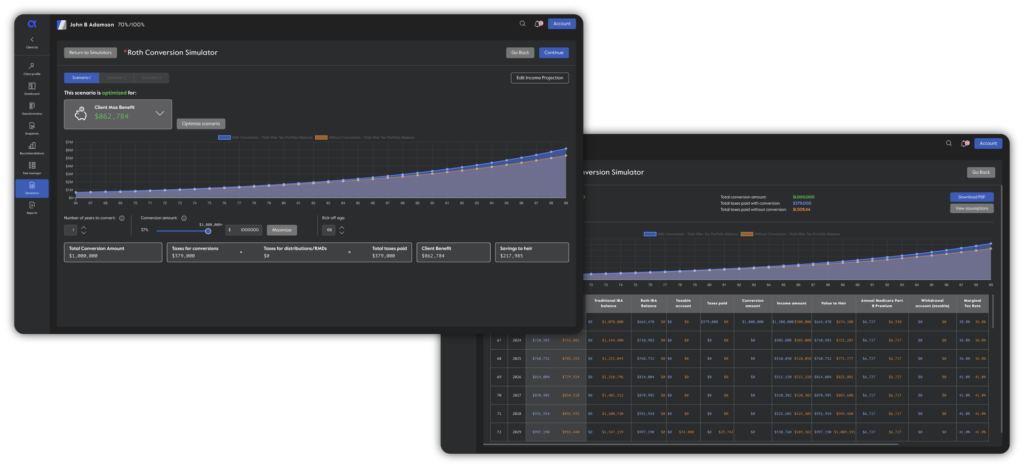

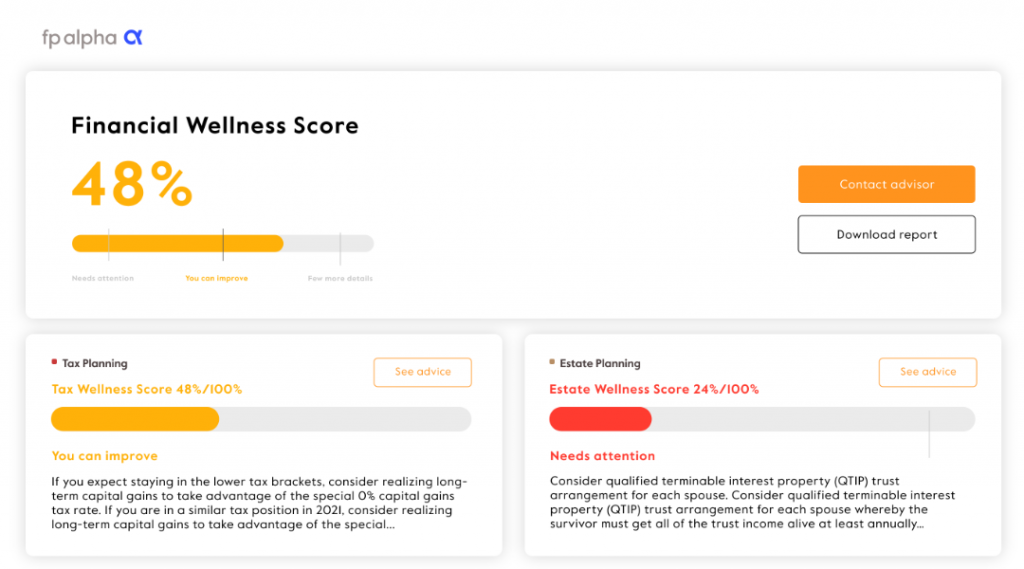

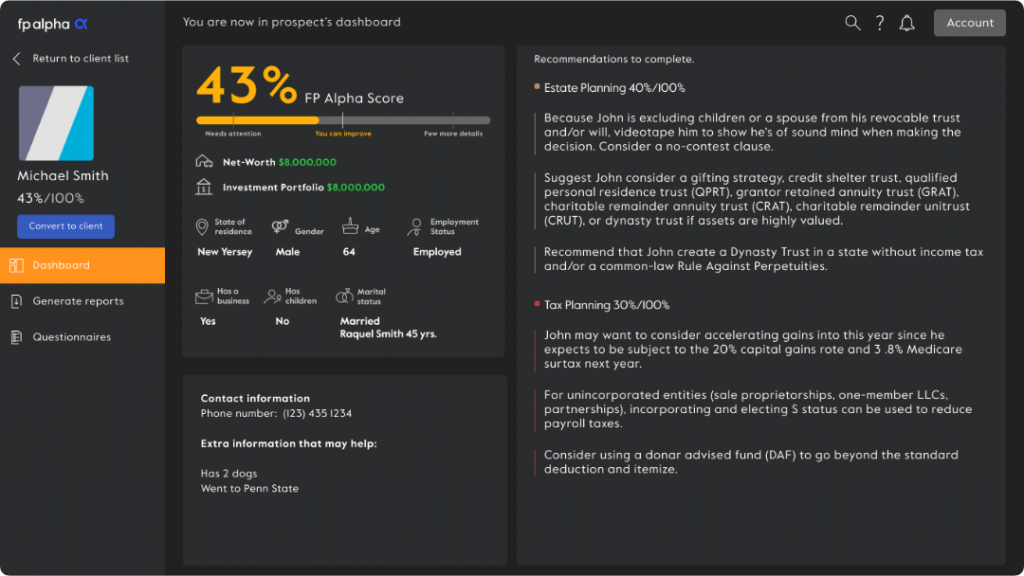

Receive Instant Analysis

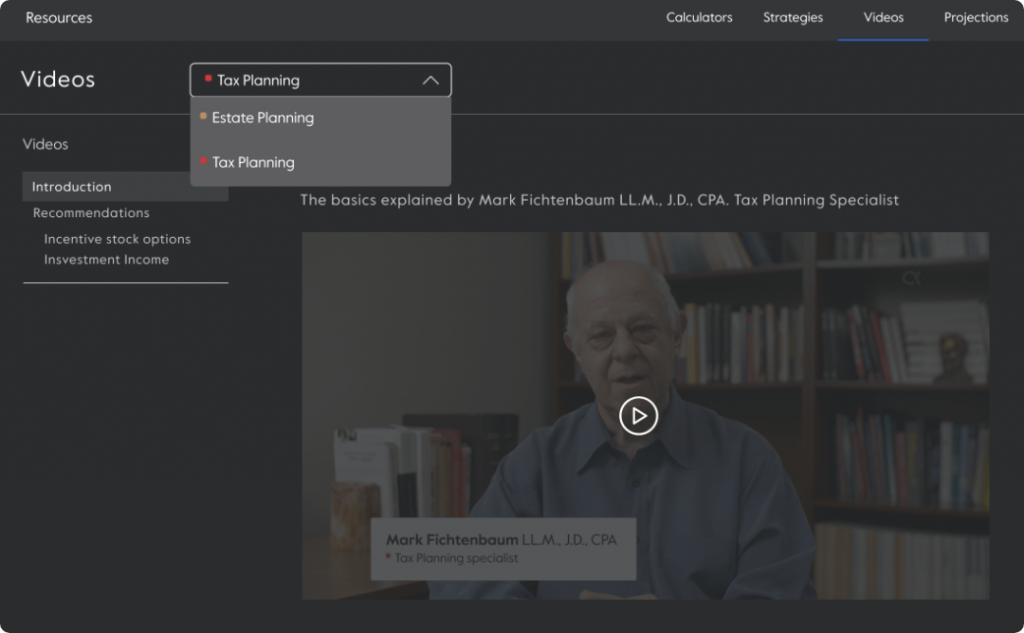

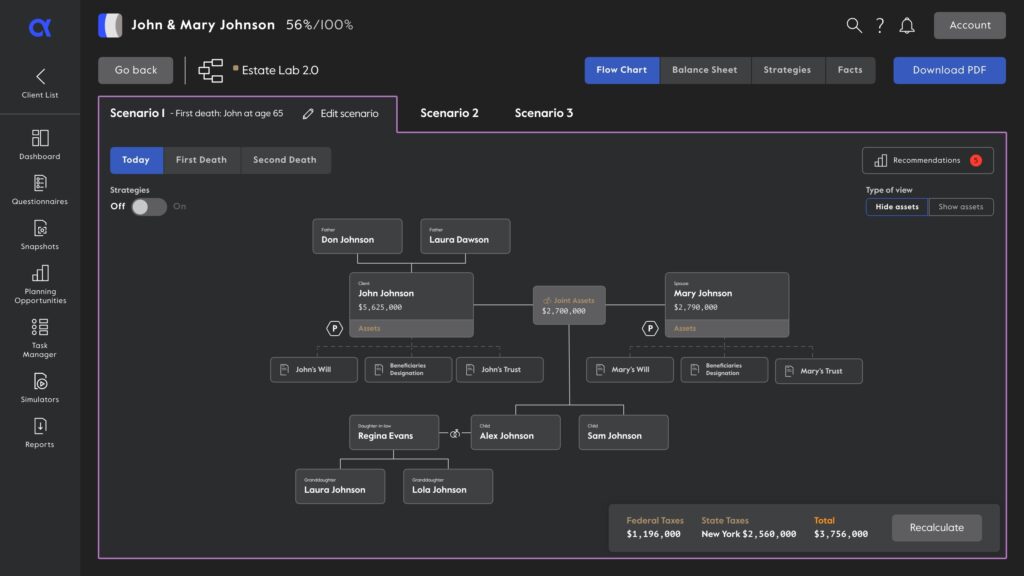

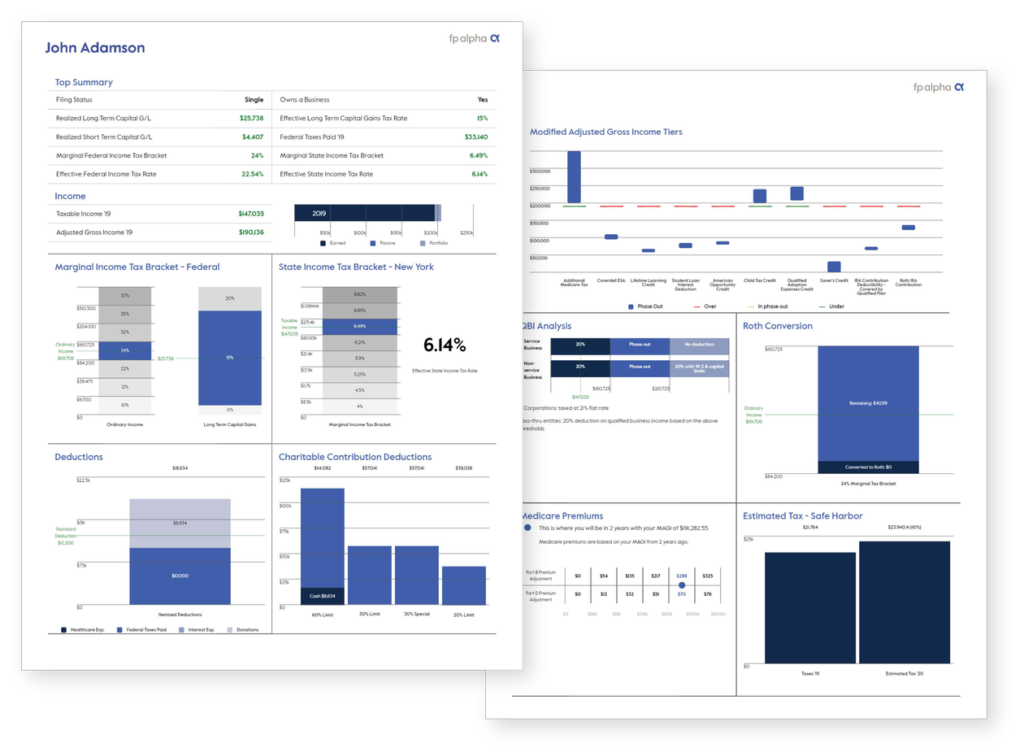

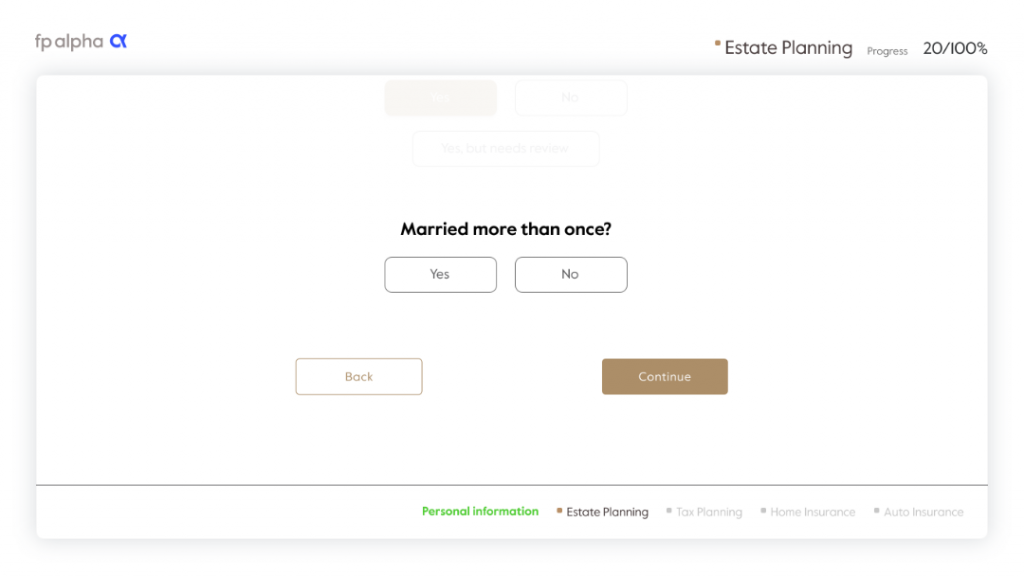

Within minutes, you’ll obtain summaries of key data and access guided insights from our algorithms built by expert CPAs, estate attorneys, and insurance specialists.

Their algorithmic, personalized recommendations identify opportunities, gaps, risks and give you the confidence you need to enter each meeting fully prepared.

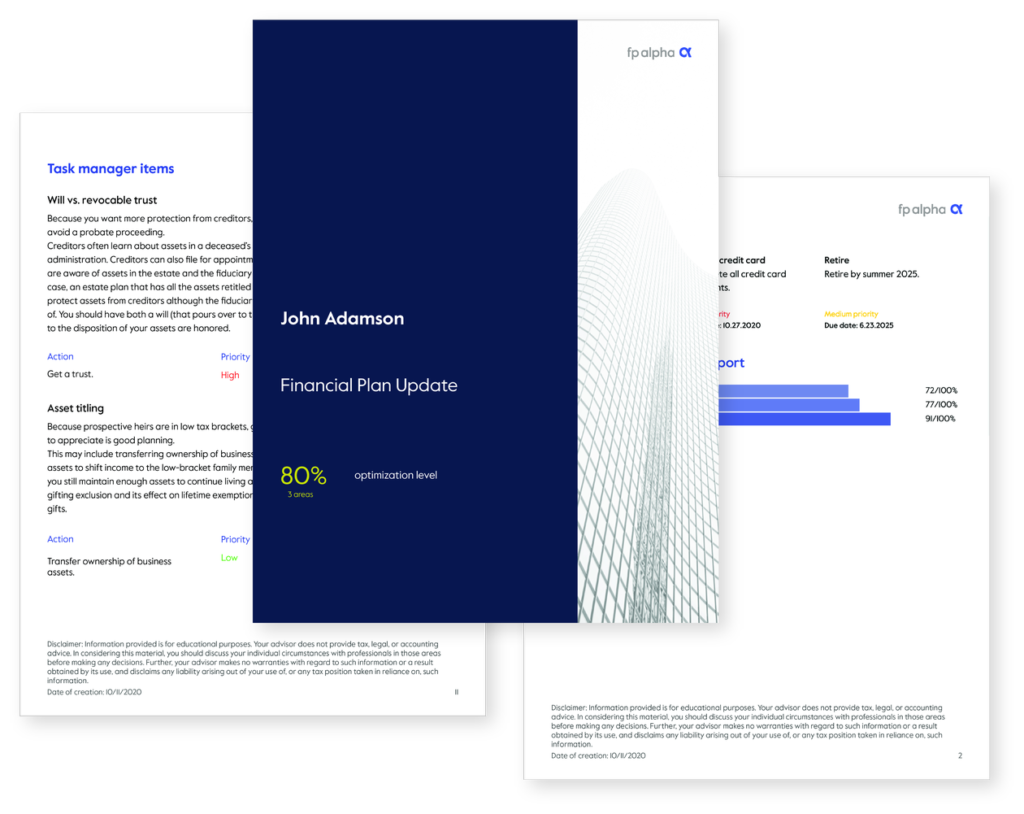

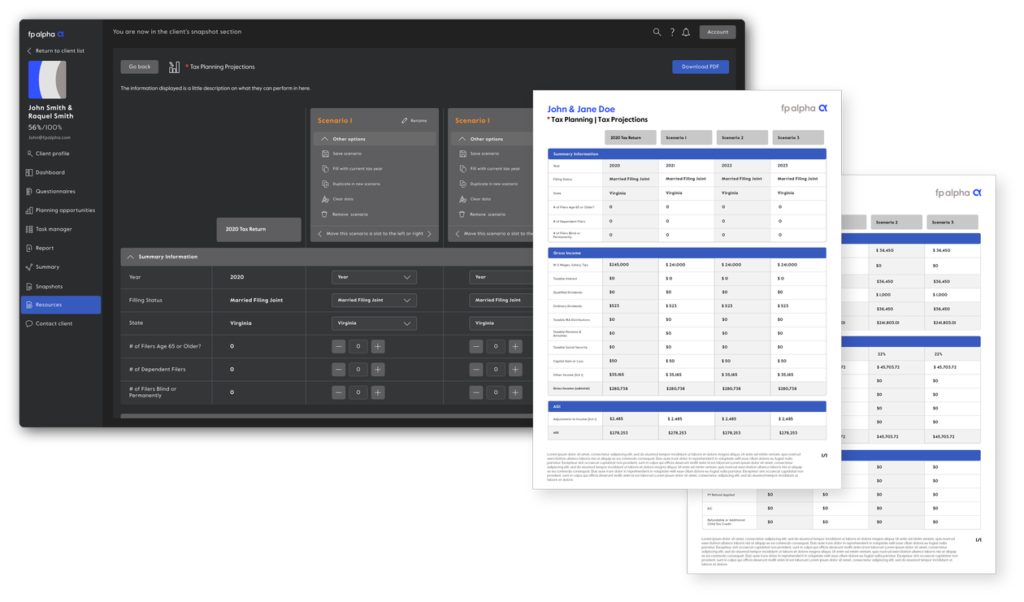

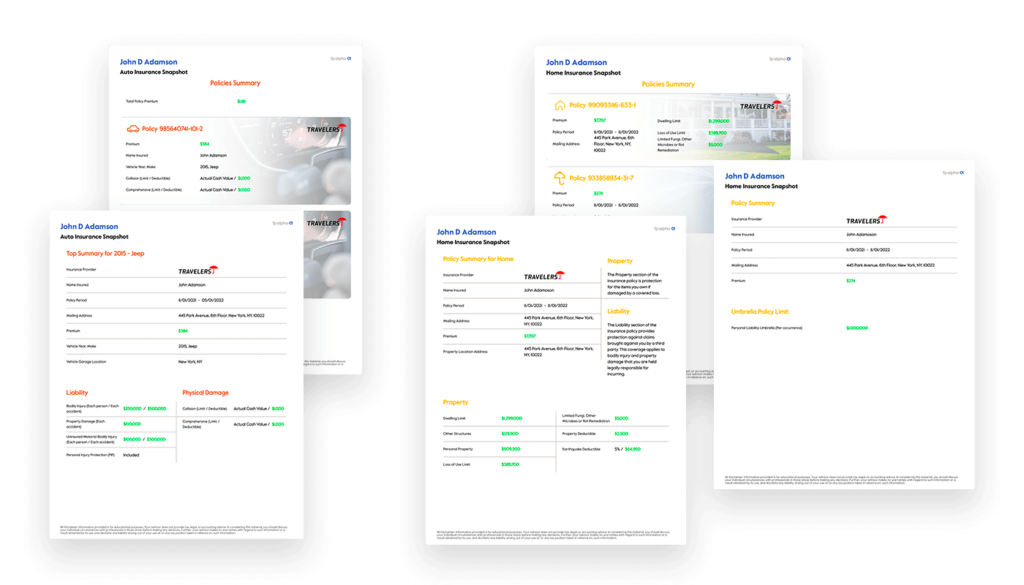

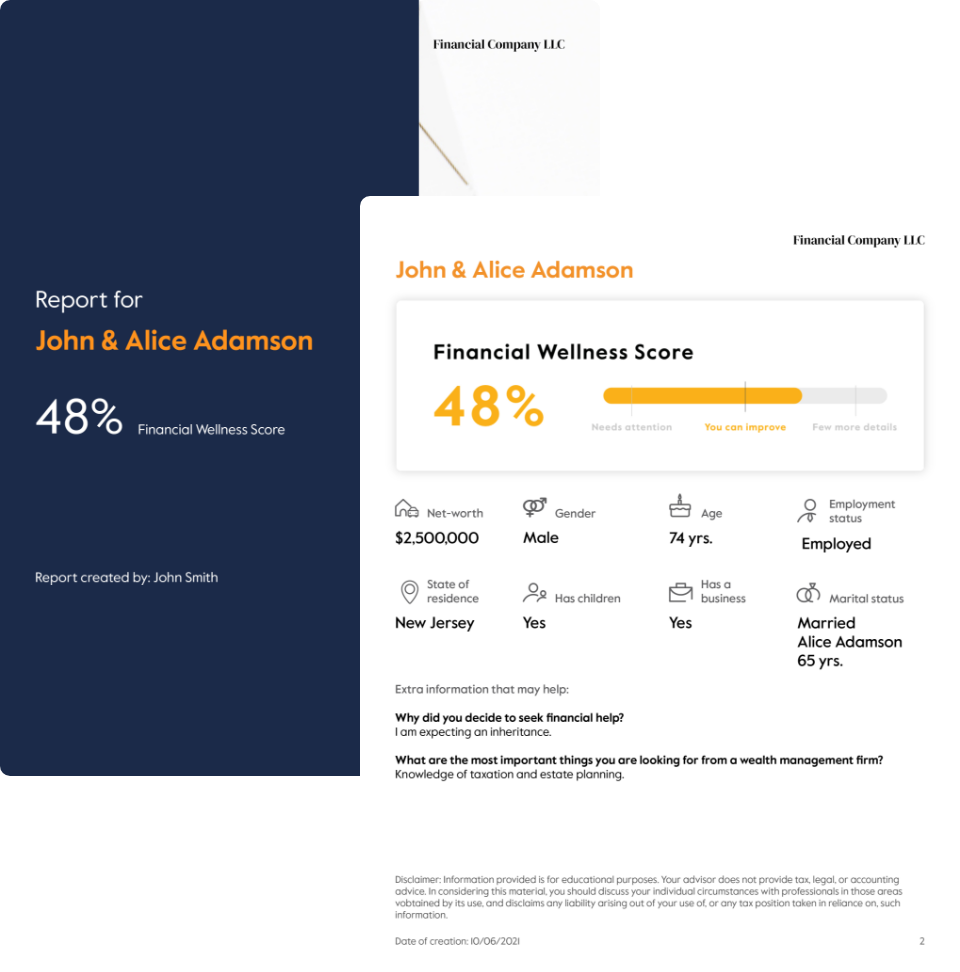

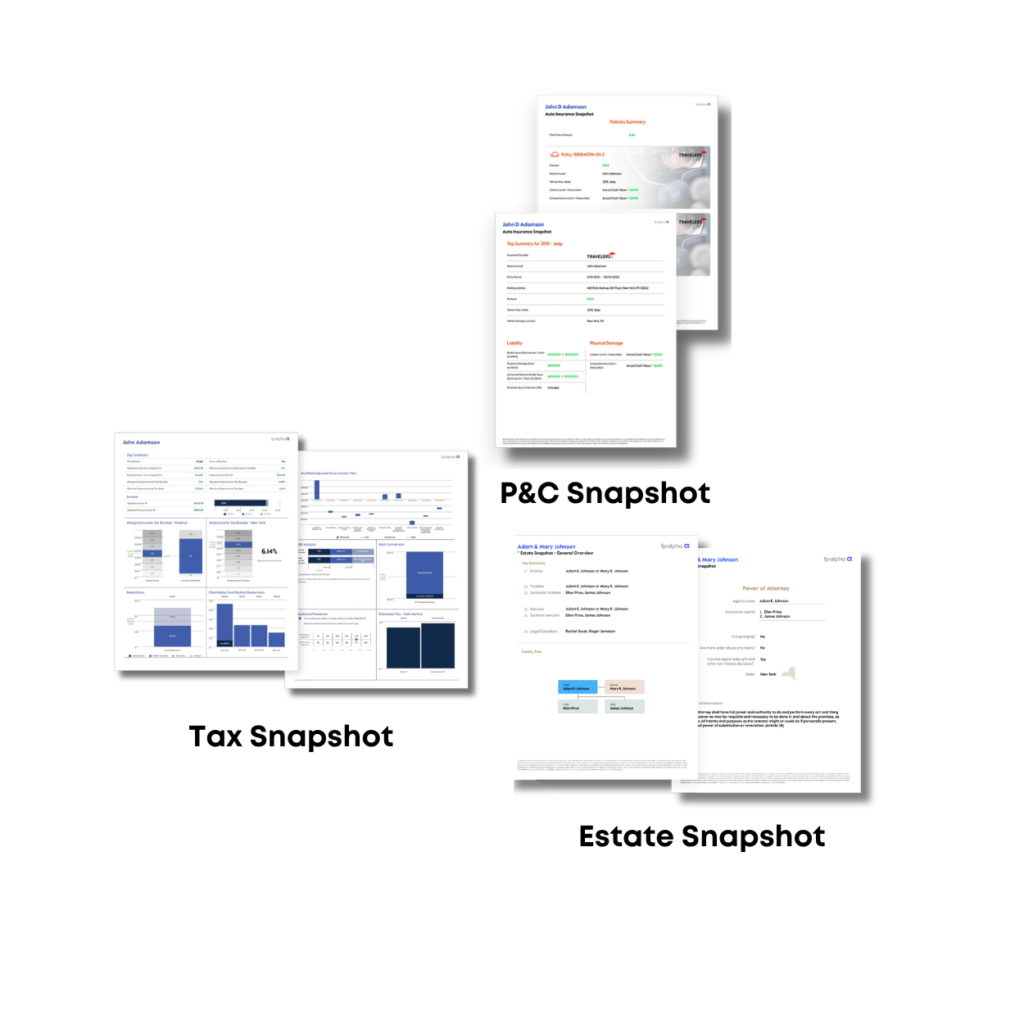

Deliver Your Advice

Once you have the analysis, it’s time to do what you do best—deliver sound financial advice to your clients with white-labeled deliverables to demonstrate your value beyond investments.